Business

A Comprehensive Guide to Effective Company Equity Planning Strategies

Table of Contents

- Understanding Different Equity Compensation Types

- Aligning Equity Plans with Company Growth Stages

- Implementing Effective Communication Strategies

- Monitoring and Adjusting Equity Plans

- Addressing Tax and Regulatory Considerations

- Leveraging Technology for Equity Plan Management

- Conclusion

Introduction to Equity Planning

Establishing a robust equity compensation plan is one of the most effective ways for organizations to foster loyalty, incentivize performance, and align the interests of employees and management. As today’s job market grows increasingly competitive, businesses of all sizes are turning to company equity planning to offer more than just salaries—empowering employees as stakeholders in long-term business growth. Designing an equity program with foresight enables organizations to boost retention, motivate key contributors, and set benchmarks for achieving critical business goals.

Navigating the complexities of equity planning also requires a deep understanding of how various plan structures and communication strategies impact organizational health. Effective equity planning is more than just deciding who gets what—it’s about building a comprehensive strategy that integrates seamlessly with your company’s lifecycle and values, helping your team feel connected and invested in shared accomplishments.

Understanding Different Equity Compensation Types

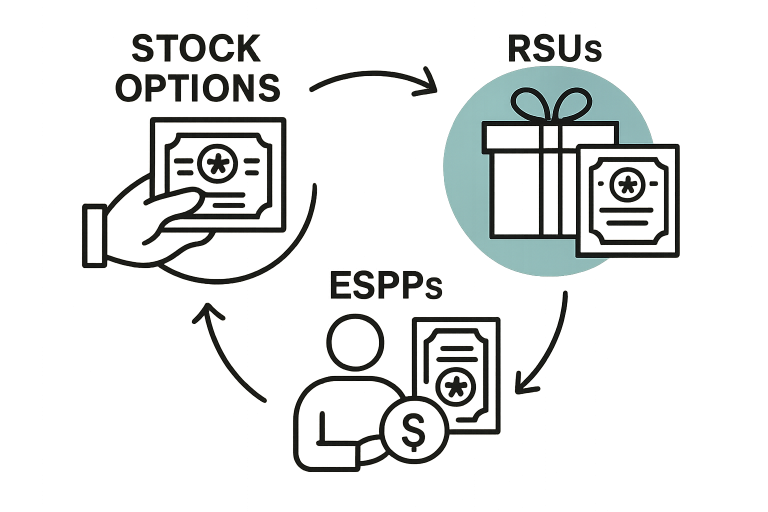

Selecting the right equity instruments is a foundational component of a successful equity compensation strategy. The three most common forms include:

- Stock Options: These give employees the right, but not the obligation, to buy company stock at a predetermined price, typically after a vesting period. This structure can be highly motivating, especially in startup environments where rapid appreciation is possible.

- Restricted Stock Units (RSUs): RSUs are grants of company shares delivered to employees, contingent on fulfilling specific vesting criteria, such as tenure or performance goals. They are less risky because they always have some value, even if the share price drops to zero.

- Employee Stock Purchase Plans (ESPPs): ESPPs allow employees to purchase company stock periodically, often at a discount and through payroll deductions, making it accessible and attractive even to those new to equity participation. According to Investopedia, understanding the features and tax implications of each type is essential for designing a plan that motivates employees while aligning with corporate goals.

The decision about which equity type to offer should take into account tax implications, dilution concerns, administrative complexity, and the motivational power for different teams and employees.

Aligning Equity Plans with Company Growth Stages

Strategic equity planning means evolving your approach as your organization changes and grows. Early-stage startups, for instance, often prioritize stock options, providing big upside potential with little upfront cash outlay. More mature companies might transition to RSUs, which deliver value even in flat markets and can support retention by providing tangible rewards over time.

Companies must evaluate their goals at each stage—whether that’s hiring, retaining critical talent, or aligning incentives for executives and key contributors. By tailoring your equity compensation structure to business maturity and financial realities, you ensure the program remains attractive and effective for your evolving workforce.

Implementing Effective Communication Strategies

Well-designed equity plans can fall short if employees don’t understand their value. Clear, transparent communication is critical for maximizing engagement and fostering a culture of ownership. Leaders should provide resources and training so employees fully comprehend how equity benefits work, how vesting schedules affect their potential payouts, and what participation means for their financial future.

Whose robust communications strategy was highlighted for ensuring staff at all levels could see the value of their awards and understand how these tied into their everyday work. Consistent and accessible resources, open forums for questions, and user-friendly digital tools are key elements of this approach.

Monitoring and Adjusting Equity Plans

Equity strategies should never remain static. Companies need to regularly review their plans to determine whether they are meeting strategic goals, keeping employees engaged, and staying in line with industry best practices. Key metrics include participation and retention rates for key talent, as well as employee feedback, which can highlight necessary tweaks or fundamental changes.

Feedback surveys, focus groups, and benchmarking against peers can provide actionable data. Making iterative improvements ensures your equity program always serves the current and future needs of both your workforce and business objectives.

Addressing Tax and Regulatory Considerations

Compliance and tax efficiency are non-negotiable components of effective equity planning. The tax treatment of equity incentives varies by plan type, jurisdiction, and employee status. Both companies and participants need to understand vesting triggers, taxable events, and possible risks. Regular consultation with tax advisors or legal experts helps companies stay compliant with evolving regulations and minimizes unforeseen liabilities for both the company and recipients.

Leveraging Technology for Equity Plan Management

Innovative software solutions now allow HR and finance teams to administer complex equity plans with far greater efficiency and accuracy. Tools range from cap table management platforms to automated vesting and reporting modules. The right technology streamlines compliance, eases participant communications, and provides actionable data insights for strategic updates. Leveraging these tools minimizes administrative burdens and supports a well-informed culture around equity compensation.

Conclusion

Effective company equity planning is a dynamic, ongoing process that requires a thorough understanding, strategic alignment, continual communication, and adaptive management. By following best practices and revisiting your strategy as your company grows, you can drive employee engagement, retain crucial talent, and accelerate long-term business success.