Finance

Diversifying Financial Strategies for Resilient Wealth Management

Key Takeaways

- Diversification reduces portfolio risk and enhances stability across market cycles, protecting your investments against sharp losses.

- Alternative investments and geographic allocation provide uncorrelated growth opportunities, expanding how your wealth can compound over time.

- Hands-on portfolio rebalancing and tailored advice from professionals support your evolving financial goals and risk tolerance.

Table of Contents

- Introduction

- Understanding Diversification

- Asset Class Diversification

- Geographical Diversification

- Incorporating Alternative Investments

- Regular Portfolio Rebalancing

- Consulting Financial Advisors

Creating a robust and adaptable wealth management plan is more critical than ever in a world where economic volatility is the norm rather than the exception. Fluctuating markets, shifting regulatory policies, and advancing global trends constantly influence asset values, making it vital for individuals and families to develop well-rounded financial strategies. Financial resilience depends on more than simply acquiring assets—it requires strategic allocation, constant vigilance, and ongoing management of your portfolio to weather a diverse range of market conditions. Increasingly, today’s investors are recognizing the complexity of modern markets and seeking the guidance of Boise wealth managers to access specialized insights that go beyond conventional investment approaches. Experienced professionals offer insights into diversification, risk mitigation, and bespoke portfolio strategies that can stand the test of unpredictable economic turbulence.

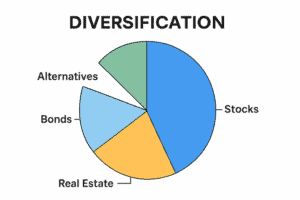

Effective diversification isn’t simply a box to check on your financial to-do list. It is the foundation of any resilient financial strategy, designed to balance risk and reward by spreading investments across distinct asset classes, varied geographic regions, and unique alternative opportunities. By investing in a diverse array of instruments—ranging from domestic stocks and global bonds to real estate and commodities—individuals can minimize the impact of isolated market downturns and position themselves to harness sustained, long-term growth. This article aims to break down actionable strategies that investors of all backgrounds can use to safeguard and enhance their wealth, helping navigate an unpredictable financial landscape with confidence and foresight.

Understanding Diversification

Diversification is the strategic process of allocating investment funds across different financial instruments, industries, and sectors to lessen the risk associated with a heavy reliance on any single asset or investment class. Rather than attempting to predict winners and losers, a diversified approach recognizes that asset classes—such as equities, bonds, and real assets—each respond uniquely to myriad economic triggers. Stocks may thrive during high-growth periods, while bonds become safe havens during market corrections. Real assets, like infrastructure or natural resources, often offer tangible value unaffected by market sentiment.

When executed effectively, diversification shields your portfolio from abrupt losses, stabilizes returns, and expands your opportunities for long-term growth. Historical evidence confirms that diversified portfolios tend to outperform those concentrated in one sector or geography by reducing the probability of extreme negative returns. Ultimately, diversification is not about eliminating risk completely—it is about smartly managing risk to maximize the reward potential over time.

Asset Class Diversification

A resilient investment strategy hinges on blending a range of asset classes, each behaving differently in response to market and economic stressors. Equities, for example, may provide significant growth over extended periods, acting as a primary engine of wealth creation. Yet, they are vulnerable to sudden market downturns, economic slowdowns, and shifts in investor sentiment. Bonds and other fixed-income instruments, on the other hand, can provide stability and income even during periods of high volatility, offering a critical counterbalance when equity markets falter.

Real assets—such as real estate, infrastructure, farmland, and commodities—add a separate layer of diversity, often rising in value under conditions that challenge stocks or bonds, including inflationary environments. Wealth management industry leaders advocate going beyond the classic 60/40 stock-bond portfolio allocation, pointing out that today’s evolving economic climate requires a broader spectrum of holdings for enhanced risk management and growth potential. Each asset class plays a specialized role, and combining them can help ensure capital resilience and more consistent returns despite shifting market sands.

Geographical Diversification

Owning investments across various regions ensures your portfolio is not overly exposed to the economic or political risks of a single country. Home-country bias—a tendency for investors to favor domestic assets—can lead to vulnerabilities if a nation’s economy underperforms or experiences a crisis. The economic risks in a country with the weakest currency in the world are significantly greater than those in economically strong nations. The challenges faced by any one national economy—such as recession, inflation, or dramatic currency fluctuations—are unlikely to impact all global markets in the same way or at the same time.

American, European, and Asian markets, for example, each have distinct growth drivers, regulatory environments, and risk profiles. Exposure to emerging markets and frontier economies expands your potential reward, but also necessitates thoughtful risk evaluation and ongoing due diligence. Many professional investors have reconsidered previously overlooked areas such as UK equities, responding to underlying value, diversification benefits, and evolving geopolitical contexts in recent years. The bottom line: Prudent geographic diversification can transform your portfolio’s ability to adapt, protecting against region-specific downturns while ensuring you participate in global growth trends.

Incorporating Alternative Investments

Diversification extends further when investors look beyond public stocks and bonds to less correlated asset classes and unconventional opportunities. Alternatives—including private equity, hedge funds, venture capital, real estate, and commodities—often do not move in tandem with traditional markets, making them valuable tools to offset risk and provide higher potential rewards. These investments may have unique risk-return profiles, differing liquidity, and opportunities for outperformance unlinked to typical stock or bond markets.

Real estate can hedge against inflation and provide steady rental income. At the same time, commodities may profit handsomely during periods of economic distress or when inflation drives up raw material costs. Venture capital and private equity can offer access to innovative, high-growth companies before they reach public markets, though with higher inherent risk and long investment horizons. A Kiplinger analysis illustrates how these assets, while less liquid and sometimes requiring higher minimum investments, can offer notable returns and portfolio insulation in unpredictable climates.

Regular Portfolio Rebalancing

No portfolio remains static in a world of economic and market flux, and unchecked performance disparity among holdings can turn a once-balanced strategy into an unintended risk exposure. Regular rebalancing—the systematic process of adjusting holdings to restore your target allocation—protects your strategy from drifting away from your intended risk profile, especially after significant market movements. For instance, after a strong rally in stocks, rebalancing may involve selling equities to buy more bonds or alternatives, bringing your allocations back in line with your goals.

This ongoing discipline not only helps you avoid letting any single asset or sector dominate your portfolio, but it can also prompt you to naturally “buy low and sell high.” Rebalancing enforces rational, thoughtful decision-making, rather than emotionally reacting to short-term market noise. Ultimately, routine portfolio reviews and rebalancing help reduce susceptibility to dramatic downturns and maximize your chances for long-term financial success.

Local context can materially influence how rebalancing and broader diversification strategies are implemented. For investors in Western Sydney, considerations such as local property market dynamics, superannuation rules, and aged-care cost projections can alter the timing and choice of assets during reviews; working with advisers who understand those nuances helps turn portfolio reviews into practical steps. Advisers such as Clarity Wealth can integrate retirement and superannuation planning with portfolio adjustments so allocations remain aligned with life-stage needs and regulatory considerations. That local insight also simplifies tax and compliance questions, allowing investors to focus on long-term objectives rather than administrative detail.

Consulting Financial Advisors

Even for seasoned investors, navigating an ever-shifting financial landscape can be complex and time-consuming. Professional advisors provide valuable expertise, not only in evaluating market trends and designing diversified portfolios, but also in monitoring economic cycles and helping clients anticipate surprises. They tailor financial strategies to individual risk tolerance, personal goals, and unique family circumstances—essentials for developing bespoke plans that evolve alongside your life stages.

Reaching out to a qualified specialist ensures that your wealth management approach remains agile, personalized, and rational over the long run—all crucial attributes for withstanding uncertainty and meeting evolving financial ambitions. Advisors bring disciplined frameworks and resources that empower clients to make informed, forward-thinking decisions. In times of uncertainty, this partnership can be the difference between panic selling and maintaining a confident, long-term perspective.

Building a resilient financial future is a never-ending process. With a commitment to broad diversification, ongoing evaluation, and expert consultation, investors can position themselves to thrive across all market environments. By embracing these principles and working with experienced advisors, you build the strength and confidence needed to realize long-term goals in the face of constant change and uncertainty.