Business

Reaching Payment Maturity: Essential Milestones for Business Growth

Your payment setup directly affects how customers experience your brand, the efficiency of your operations, and, ultimately, your business’s profitability. Companies with a top-notch payment ecosystem can quickly adapt to market changes, manage transaction risks better, and seize new opportunities with ease.

The payment maturity model is a powerful tool for assessing your payment setup. In this article, we’ll break down each level, explain its significance, and guide you on advancing. By understanding and applying this model to your business, you can streamline your payment processes, reduce costs, and pave the way for sustainable growth.

Payment maturity concept explained

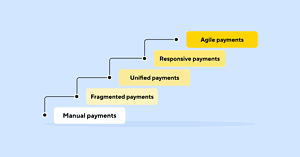

The payment maturity model is a structured framework that helps businesses assess and enhance their payment processing capabilities. It guides the evolution from basic, manual methods to advanced, unified payment platforms that promote innovation and efficiency. Serving as a diagnostic tool, this framework enables businesses to determine their current level of payment maturity and plan the necessary steps to advance.

The classification system developed by Corefy’s CEO & Co-founder Denys Kyrychenko outlines five distinct levels. Each level signifies a notable advancement in the sophistication and efficiency of payment systems, culminating in a highly agile and integrated payment infrastructure.

Let’s discover each level in detail.

5 levels of payment maturity

Level 1: Manual payments

The first level in the payment maturity model is where many startups or small businesses begin their journey toward better payment processing. At this stage, everything is handled manually without any automated systems.

There is no need for complex payment gateways or advanced software solutions yet. Businesses typically handle transactions using basic merchant accounts or simple online payment tools. The primary goal at this stage is to establish the business and maintain operations, focusing on staying afloat and setting the groundwork for future growth and more sophisticated payment processing systems.

Level 2: Fragmented payments

When merchants start to see an increase in transaction volumes, there’s a need for more robust payment solutions to manage their payments effectively. At this level, businesses have moved beyond purely manual processes by incorporating external PSPs to handle transactions. While these systems are not fully integrated, they offer a more reliable and scalable solution for managing payments. This partial automation helps to reduce manual effort and errors, providing a step up in efficiency.

The main objectives at this level are stabilisation and a focus on availability, reliability, and consistency. Small merchants aim to grow their transaction volumes while ensuring their payment systems are dependable and always available.

Level 3: Unified payments

Moving to unified payments is a big step forward in the payment maturity model. This stage involves integrating with more payment service providers (PSPs) to increase flexibility and offer a wider range of options for customers.

At this level, businesses implement a CRM for payments, which becomes the core of their payment process. This system brings all payment activities together, centralises transaction management, and automates billing and invoicing. It integrates various payment methods and providers into one smooth, unified platform.

By centralising and automating payment processes, businesses can focus on growth and innovation, leveraging the unified system to provide a seamless and reliable payment experience for their customers.

Level 4: Responsive payments

At the Responsive level, businesses have payment systems that are flexible and can easily handle large transaction volumes. These systems are designed to quickly adapt to market trends, regulatory compliance changes, and new technologies with minimal disruption.

At this stage, a payment gateway or hub is the central solution, streamlining all payment activities. Businesses also start using advanced features like real-time analytics, smart routing, and AI-driven fraud detection. These tools provide deeper insights into payment processes, optimise transaction success rates, and enhance security.

Companies operating at this level are well-equipped to manage the complexities of digital payments. They can handle high transaction volumes smoothly and respond swiftly to any changes or challenges. This flexibility and responsiveness allow them to lead in innovation and customer satisfaction, setting new industry standards.

Level 5: Agile payments

The pinnacle of payment systems, agile payments, involves leveraging cutting-edge technologies and strategic insights to build a payment ecosystem that’s both dynamic and incredibly responsive.

At this level, a full-fledged payment processor acts as the comprehensive hub of all payment activities. This powerful system seamlessly integrates with numerous payment service providers (PSPs), offering unmatched flexibility and efficiency. The implementation of advanced payment infrastructure and cross-border payment capabilities further strengthens a company’s position in the global market.

Companies at this stage leverage advanced automation, predictive analytics, and real-time data processing to stay ahead of industry trends. Proactive fraud detection and customised payment solutions ensure exceptional security and superior customer experience, solidifying their position as leaders in payment innovation.

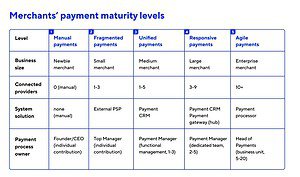

Here’s a table summarising the critical characteristics of every maturity level:

How to level up your payment maturity?

You’ve likely assessed the current maturity level of your payment infrastructure. But if you’re not at the most advanced level, what steps can you take to get there? Let’s explore the strategies.

- Embrace automation and integration: Move beyond manual or fragmented payments by automating repetitive tasks and integrating various payment systems. A unified payment platform can give you a clear overview of all transactions, making operations smoother, reducing errors, and boosting efficiency. For those looking to offer customisable solutions, integrating a white-label payment gateway can be an effective strategy to enhance your payment infrastructure.

- Expand payment options: Offer a variety of payment methods and PSPs to avoid relying on just one source and to serve a diverse customer base. This flexibility is key as you grow. More payment options mean happier customers and more successful transactions.

- Invest in advanced features and security: As your payment system matures, adopt features like smart routing, real-time analytics, and AI-driven fraud detection. It’s also crucial to beef up security measures to protect customer data and comply with regulations, ensuring your system grows safely.

- Leverage data for informed decision-making: Use your payment system’s data analytics to understand customer behaviour and transaction patterns. Use these insights to make smart decisions that improve your payment processes.

- Stay updated and adapt: Keep an eye on industry trends, new technologies, and regulatory changes. Being adaptable and ready to implement new solutions will ensure your payment systems stay efficient, secure, and competitive.

Conclusion

Improving your payment maturity isn’t a one-time thing – it’s an ongoing process. Regularly reviewing your payment operations, keeping up with technological advancements, and responding to customer needs will help your business achieve and maintain a high level of payment maturity.